Unexpected Turbulence: The Xiaomi Electric Vehicle Crash Shakes Up Autonomous Driving Debate

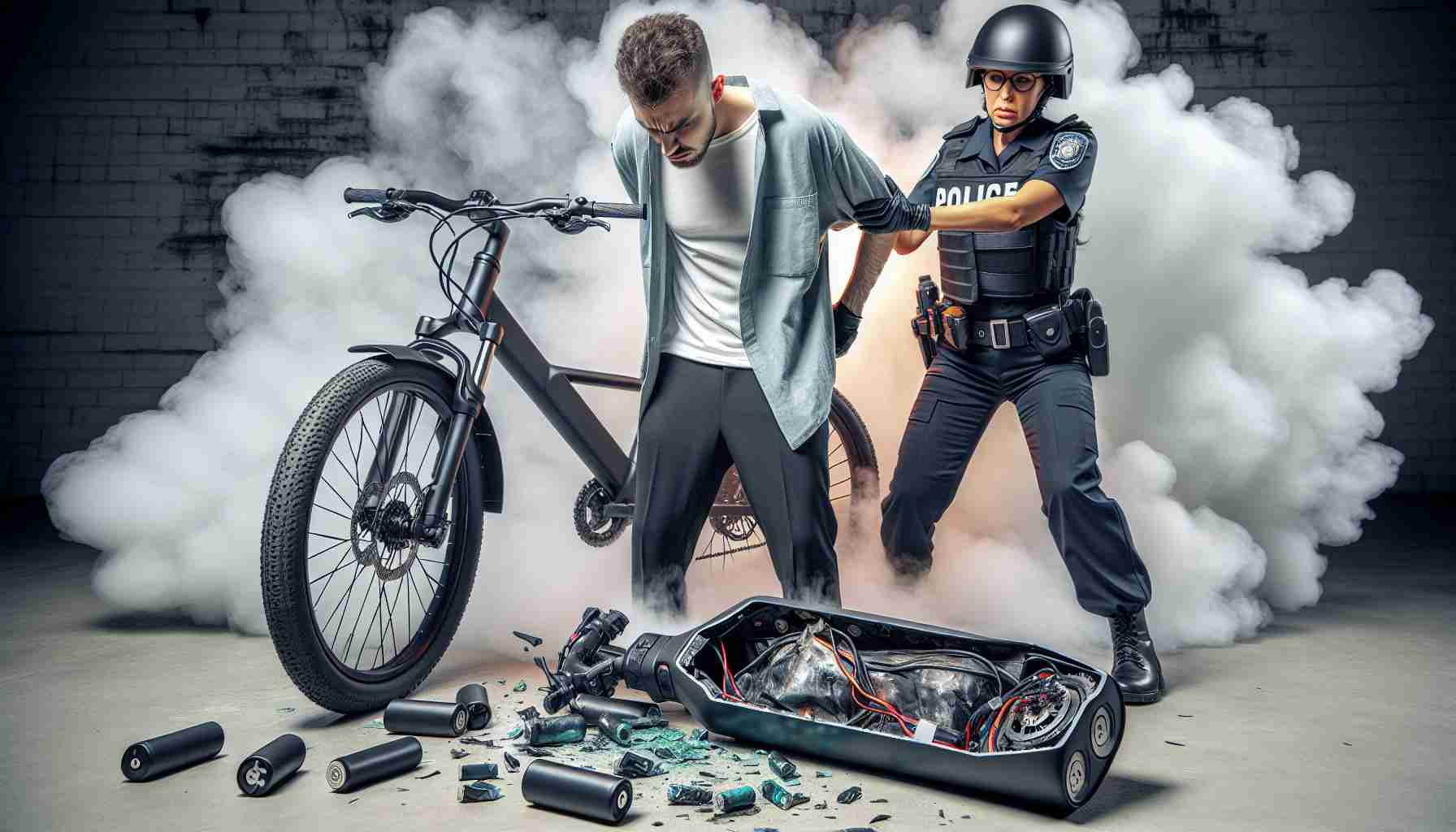

A serious accident involving a Xiaomi SU7 EV on a Chinese expressway has sparked debate about autonomous driving safety and innovation. This incident emphasizes